Below is a summary of some of the most relevant types of taxes in Japan for foreigners. Japan’s taxes on income, property, and consumption are paid at national, prefectural, and municipal levels.

Introduction to Taxes in Japan For Foreign Residents

Property Tax

Municipal tax paid yearly by individual citizens who do own land, housing, and other types of depreciable property.

Consumption Tax

The consumption tax is needed to pay by consumers when they purchase goods and services. The rate is generally 10% nationally.

Vehicle-related Taxes

Prefectural car tax is paid yearly by individual citizens who own a car, a truck, or a bus. In the case of passenger vehicles, the amount of tax is calculated based on engine displacement. Municipal tax on light vehicles is paid annually by individuals who own motorcycles or other light vehicles. The prefectural car acquisition tax shall be paid by persons when they acquire a car.

Liquor, Tobacco and Gasoline Taxes

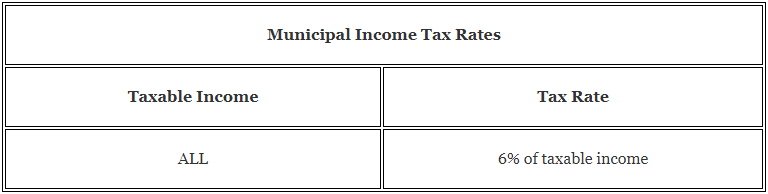

Resident Tax

Another, and the one that many of us tend to ignore, is municipal or city tax (resident tax). Unless you work for a government agency, the chances are that this tax will not be deducted at source.

You will receive a bill from your local city tax authority, which you can take to a local convenience store to pay for. It is typically calculated based on 6% of your annual income. However, as was the case with income tax, it is calculated based on your previous year’s salaries. As such, during your first year in Japan, you will typically not be charged for resident tax.

For instance, a typical English teacher in Japan will have to pay between 100-150,000 yen a year for this tax, and it may seem like a frightening prospect. Fortunately, it can be broken down into three manageable payments in June, August, and January of the next year. You’re going to have to discuss this out with your local tax authority.

If you’re just a non-permanent citizen, be sure not to fall behind with this one. In recent years, the government has stepped up the enforcement of municipal tax collection, and failing to pay can negatively impact the chances of a visa renewal. Please be reminded that municipal tax is charged based on the city you live in, not where you work.

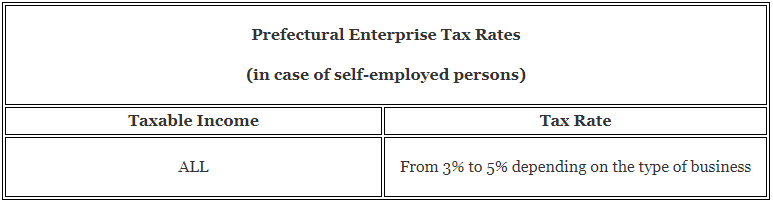

Enterprise Tax

Enterprise tax is prefectural income tax annually by self-employed persons engaged in business. The amount is calculated based on the net the income of the person and the type of enterprise.

Income Tax

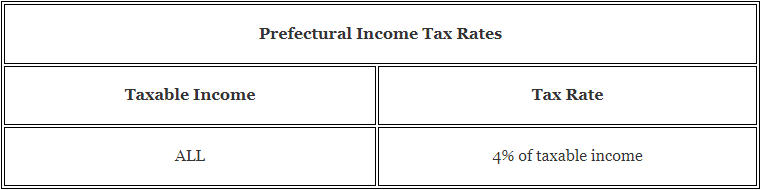

Formerly known as Prefectural and Municipal “Resident Tax.” The amount is determined

based on the individual’s net income.

People living in Japan are defined into three categories for income taxation purposes. This classification is not related to the types of visas:

Non-Resident

People who have been living in Japan for less than a year and do not have their primary living base in Japan. They only need to pay taxes on income from Japan’s sources domestically but not on income outside the country.

Non-Permanent Resident

People living in Japan for less than five years and have no intention of living in Japan permanently. They need to pay taxes on all income except outside income which is not sent to Japan.

Permanent Resident

People who have been living in Japan for a minimum of five years or currently preparing for permanently staying in Japan. They have to pay taxes on all income, both from Japan and outside Japan.

Note that tax treaties between Japan and more than 50 countries, including the USA, UK, Canada, Australia, China, South Korea, and most European countries, can precede the above guidelines.

How to Pay Taxes & Taxes Return

In Japan, income tax is based on a self-assessment system (people determine the tax amount by filing a tax return file) combined with a withholding tax system (taxes are deducted from salary and submitted by the employer).

Most employees in Japan do not need to file a tax return, thanks to the withholding tax system. In fact, they only need to file a tax return if there is existed one of the following conditions:

- Plan to leave Japan before the end of the tax year

- The employer does not withhold taxes (e.g. employer outside Japan)

- Having more than one employer

- Total income is more than 20,000,000 yen annualy

- There are side incomes of more than 200,000 yen total

Employees who do not need to file a tax return will have their income taxes withheld from their owner’s salaries, and an impending adjustment will be made with the final salary of the year. People required to file a tax return, such as self-employed persons, must do so between 16 February and 15 March of the following year at the local tax office (zeimusho), by mail or online (e-Tax).

When to Pay Taxes?

If the employer does not withhold, national income taxes will be due in full by March 15 of the following year (mid-April if you pay by automatic bank transfer), with two prepayments payments in July and November tax year. Prepayments are calculated based on income from the previous year.

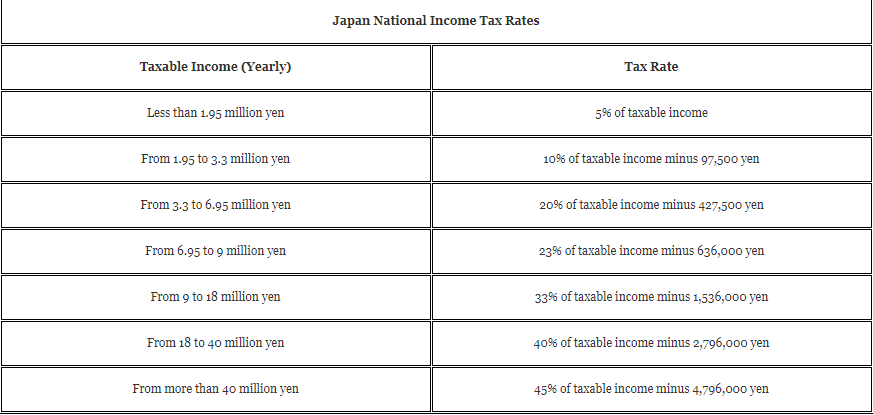

National Income Tax Rates

The tax rate is determined based on taxable income. As in other countries, the taxable income is the total revenue minus a basic exemption, exemptions for dependents, and various types of deductions, such as insurance premium deductions, medical expenses, and self-employed business expenses.

What Did You Learn About Taxes in Japan?

We do hope you find our article a useful piece of information. Still, there are plenty of aspects in Japan’s taxes, such as Saving Taxes, Tax Free,… Those will be the Guidable team’s next article topics of our new “Ultimate Guide: Taxes in Japan” series.

After all, all of our activities are aiming for a better life for foreigners in Japan! So, stay tuned and follow us!