As of the end of January 2019, Mr. Howard Schultz, the substantial founder of Starbucks, declared “I am considering” to run the US presidential election in 2020. If such a movement becomes active in the future and various events that shake the current administration occur, it is considered that a big change in the world economy will occur.

This is no exception in Japan where we are, especially the real estate industry is greatly affected by the policy of the government. As far as Japan’s real estate industry is mentioned, the influence of the Japanese government is very strong. If the leader changes and the policy of the government changes, the current real estate industry will change dramatically.

Especially, it can be said that the real estate market in Japan is currently greatly influenced by the government policy.

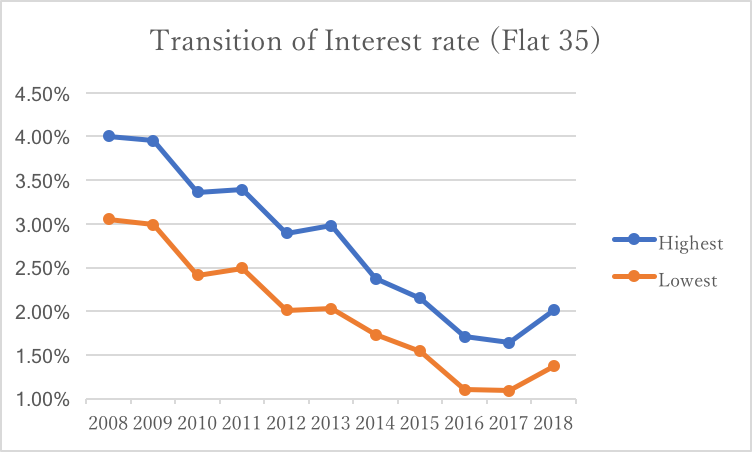

One example that is heavily influenced is the upward and downward movement of the mortgage rate due to easing of finance. Please see the figure below.

※Created by the author based on interest on flat 35

If you look at this, you can see that the mortgage rate in Japan has dramatically declined. This is Flat 35, which is a fixed interest rate for 35 years. At floating interest rates, financial institutions offering low-interest mortgage loans of less than 0.5% are appearing. As a factor behind these low interest rates, the fact that the Bank of Japan, which had been promoting large-scale monetary easing, introduced “quantitative and qualitative monetary easing with negative interest rate” has a big influence. The price of real estate is greatly influenced by this historical low interest rate and the price fluctuates. Please see the figure below.

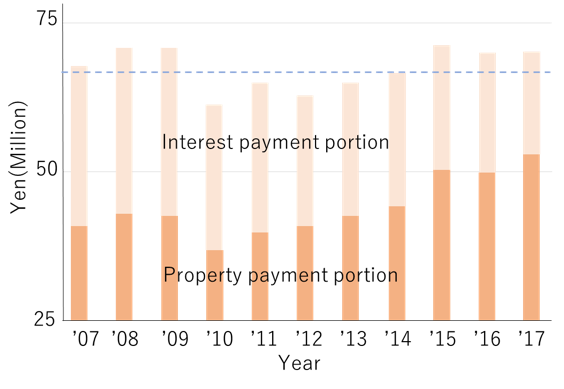

※Created by the author based on White Paper of Tokyo Kantei Mansion Data 2017 (Metropolitan Area) & Sumitomo Mitsui Banking Corporation Mortgage Data

The figure above shows the trends in real estate prices rise and the corresponding interest payments. Looking at this, you can see that real estate prices have risen significantly since 2010. However, due to the decline in the mortgage interest rate, it is also characteristic that there is no big difference in the amount of money finally paid.

In other words, as the state of the economy, when the real estate price is rising, it can be said that the mortgage rate is falling so that the number of people who can buy will not decrease. Conversely, if the real estate price falls, the interest rate will rise accordingly. There is an argument that whether interest rates are moving up or down the real estate price or whether the real estate price is moving the interest rate up and down, but since this works mutually, there is no clear answer.

And recently, as shown in the first figure, the interest rate has been rising since 2018. From this movement, it is predicted that real estate prices will turn to a downward trend. However, this does not apply to all real estate, but depending on each property situation, there are also some properties that continue to rise since 2018.

In assessing property prices, it is important to objectively judge from future prediction, present and past sales situation. All real estate companies should be able to assess the sale from the perspective of the future, present and past. So, when considering selling your own real estate, we recommend that you ask a company that will submit assessment materials you agree with objective data.

My company, LINC Inc., as a real estate agent specialized in foreigners, provides visualization of objective data on Japanese real estate market and sale assessment which foreigners are hard to grasp easily. When you want to assess your precious property, please ask our agent.

For a personal consultation or to join the ” How to Sell Buy and Sell Property in Japan” Seminars please sign up at the form below:

https://docs.google.com/forms/d/e/1FAIpQLSe95Jhp-WantePXtbwVNsnRJTSfwMgffvO1TkjeeBjbrbmDtA/viewform

For more information about the seminar check out this article:

[:en]Free Seminar: Introduction to the Way to Buy Your Dream Home and Sell Property in Japan![:]